When I was a teenager I can always remember my father telling mine about why home warranty was so important and how essential it was for protection in the home. I took my dad’s advice to heart and when I eventually bought my own place I immediately started to compare home warranty policies and read reviews of various plans that I could get.

Eventually, I decided that the money would be better off in my pocket and so for the first year I decided against the policy, much to my father’s frustration.

After things improved a little financially I did eventually decide to take my dad’s advice and I after reading the First American Home Warranty Reviews I decided that this would be the best company for me, and many experts agree.

I am so happy that I took that home warranty policy because just a few months later I was on the phone customer service making a claim, and I thanked my lucky stars for my father’s advice. If you aren’t aware of why this is important for homeowners, here is just why it is.

1Full Protection

There is a common misconception that people who have home insurance make, in thinking that their policy is going to protect them against everything, but the reality is that it will not and there are many aspects of the home which aren’t covered under the policy.

What we need to understand here is that home insurance covers you against damage to the structural integrity of the home and damage or loss to the contents of the property. A home warranty, on the other hand, is there to protect the systems inside the home. Let’s assume that the sink in the bathroom begins to leak and that you arrive home to a completely flooded downstairs.

Your home insurance policy will make sure that any damage which the flood has done to your property, to the walls, the floor, the carpet or any other area is fully paid for. What the home insurance provider will not do however is offer you any support in helping to find and fix the leak, or the damage which has been done to your plumbing system, that is where a home warranty comes in.

As you can see, combined with home insurance, a home warranty will give yo maximum protection.

2Natural Disasters

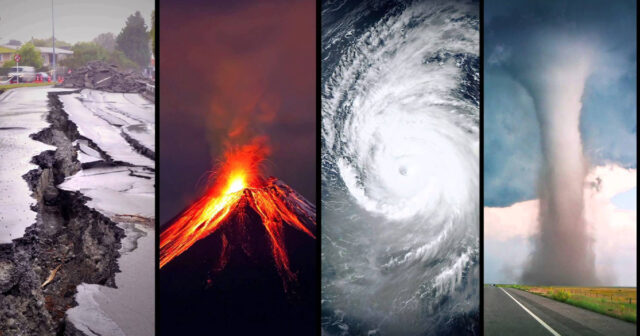

We saw first-hand last year just how devastating natural disasters can be and from fires in California to hurricanes in Florida, and if you live in an area where there is a strong probability of a natural disaster then you are going to want to make sure that you have the protection that you need.

As we can see, there is a lot of benefits to having both home insurance and a home warranty policy and if disaster does strike then having both will ensure that you are not ruined financially in the event. If you want to find more about home insurance, and how bad do you need it click here and find all necessary information you need.

3Best Workers

Another great benefit of a home warranty policy is that these companies work with the very best tradesmen and women, making sure that when you do have a problem, they arrive at speed and they complete the work to a very high standard. Let’s say that your HVAC system goes out in the middle of summer, who would you call?

How would you know who the best person is? Most people in this situation would have to call around for prices, get recommendations to ensure thy get the best person and then wait in the sweltering heat until the team comes out. When you have a home warranty policy however you will only have to make a single call and they will get the very best out to you in no time at all.

4Unexpected Costs

Something which I didn’t realize until I got the home warranty policy is that it can really help you with your financial planning. When I look ahead to the year now, there is less importance in having some money set aside in case something goes wrong in the home, because in that event the most that I would have to pay would be the excess amount.

I still do keep some money to one side of course but the point is that there is far less pressure on being prepared financially in the event of something happening in the home. This not only gives you peace of mind but it can also help you financially, at least in the long term.

I was lucky to get through that first year without the need for a home warranty policy, and I am very happy that I have one now because of the proaction which it offers me and my family, and you will be too.